If your office is starting to feel cramped, it might be time to start considering a new space. But how do you know if you really need a new office, and when is the right time to make the move?

Here are a few things to keep in mind when making your decision:

How is the size of your company changing?

If you’ve recently added a few new team members or are planning to grow your team, a new office might be necessary to accommodate everyone comfortably.

How is the layout of your current office serving your needs?

Does your current space utilize space efficiently? Are there areas that could be better utilized? If you’re outgrowing your current office, a new one with a more efficient layout can help you make better use of your space. Alternatively, with the increase in virtual meetings for most office spaces, perhaps finding a conference room or quiet meeting spaces will better serve your needs. Consider how your space is used, or rather, not used. Think about how your conference room space functions. Do you have too many spaces? Not enough? Reach out to FSI for space planning help and to complete a space usage audit. Read more about space usage audits here.

Does your current office space represent your company’s image?

Older offices can be dated not only in style but also in architectural design. They can start to show their age through their repair needs. New office space can provide a fresh start for an organization and help create the business environment you want. If you are looking to upgrade your office to project a more professional image, a new space can be a good investment. For office interior design inspiration, check out our portfolio of recently completed office design projects.

How Much Does it Cost to Relocate an Office?

The cost of relocating an office can vary depending on a variety of factors including: the size and location of your new office, any final move-out costs at your current office, the amount of office furniture and equipment you need and whether you’re hiring professional movers.

On average, businesses spend between $5,000 to$10,000 on office relocation costs. However, if you’re moving to a larger space, purchasing new furniture or hiring professional movers, your costs could be higher.

When is the Best Time to Move?

The best time to move office depends on your business needs. If you are expanding your business or in need of a more efficient space, it might be time to make a move sooner rather than later. However, if you can make your current office work for you, there’s no need to relocate right away.

If you’re considering a move, the best time to do it is during the less busy times of winter or summer. This can help you save money on office rental costs and professional moving services.

How to Relocate an Office

If you’ve decided to relocate your office, there are a few things you need to do to ensure a smooth move.

- Notify your team members of the move as soon as possible so they can prepare for the transition

- Work with your IT representative to determine the safest way to transport your technology

- Hire professional movers to help with the heavy lifting and transport of office furniture and equipment

- Schedule the move for a time that won’t disrupt business operations, such as after hours or on the weekend

- Notify any clients, partners or other stakeholders that might be affected by your move.

- Update your office address and contact information on your website and all marketing materials

By following these steps, you can make sure your office relocation goes smoothly and doesn’t interrupt your business operations.

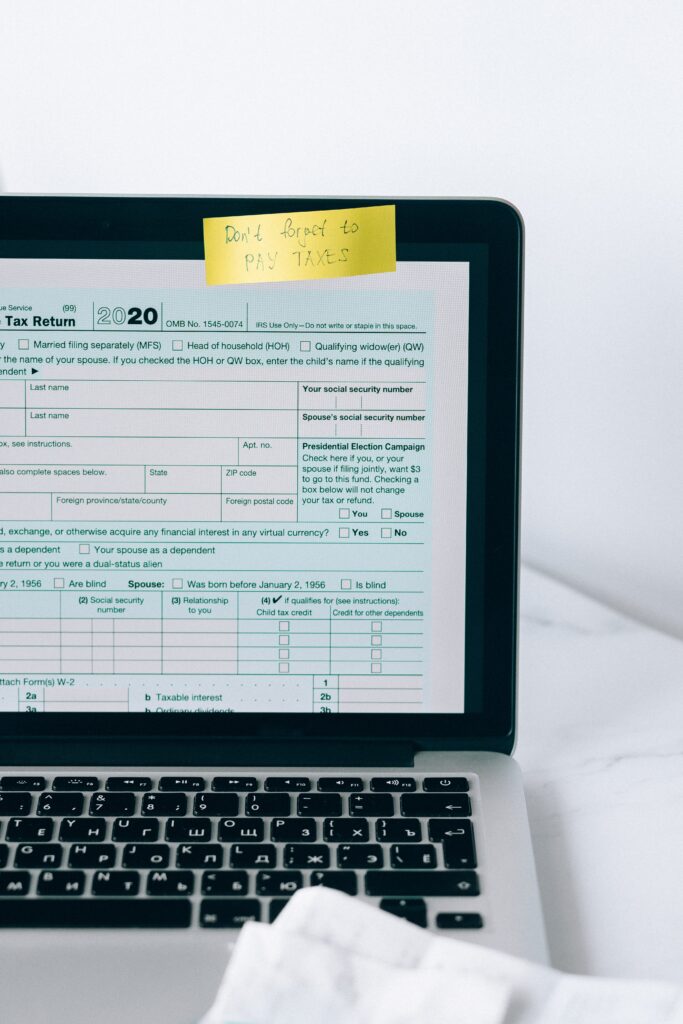

Are office relocation costs tax deductible?

Office relocation costs may be tax deductible if the move is for business purposes. For example, if you’re relocating to a new office to accommodate your growing business, the costs of the move may be tax deductible.

To deduct office relocation costs, you’ll need to keep track of all expenses related to the move and save any receipts. This includes costs such as renting office space, hiring professional movers, and transporting office furniture and equipment.

When it’s time to file your taxes, you’ll need to itemize your deduction by listing all office relocation expenses. You can then claim the deduction on your income tax return.

Consult with a tax advisor and pay attention to the IRS’s Moving Expenses forms to ensure office relocation costs are eligible for a deduction on your income tax return.

Where do I go to look for furniture and technology for the new office?

Businesses can purchase furniture from any store they would like from chain retailers to neighborhood garage sales. For offices that want a consistent, reliable and proven partner for `spaces in your area. At Facility Systems, Inc., we have decades of experience in outfitting Kansas City area offices. Contact us today to learn more about FSI’s ability to help you plan for your office transition.

Making the decision to move offices can be daunting, but with our recommendations at FSI and input from your team, it can be one of the best decisions you make for your business.